KreditBee offers salary advance loans through its mobile app and website. You can avail instant KreditBee personal loan online of up to Rs. 5 Lakhs at an interest rate of 1.02% p.m. and tenure up to 24 months.

| Interest Rates | 1.02% p.m. |

|---|---|

| Loan Amount | Rs. 1,000 - Rs. 5,00,000 |

| Tenure | 3 Months - 24 Months |

| Loan Processing Fee | 0% - 6% of the sanctioned loan amount |

| Turnaround time | Entire process from registration to disbursement takes maximum 15 minutes. |

| Purpose | Medical emergency, domestic functions, education, travel, payments of existing debts & insurance, and other financial emergencies. |

Note: KreditBee is powered by https://www.kreditbee.in/ and the information mentioned here is provided by Finnovation Tech Solutions Private Limited.

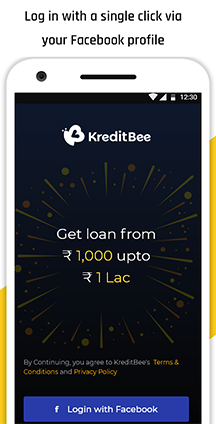

Kreditbee App

KreditBee Personal Loan Interest Rates

KreditBee Personal Loan Features and Benefits

Types of KreditBee Loans

Eligibility Criteria For Kredit Bee Personal Loan

Documents Required For Kredit Bee Loan

How to Apply Kredit Bee Personal Loan

KreditBee Personal Loan Application Status

KreditBee Customer Care

KreditBee App offers instant personal loans up to Rs. 5 Lakhs to salaried individuals against their salary to help them meet their urgent financial requirements.

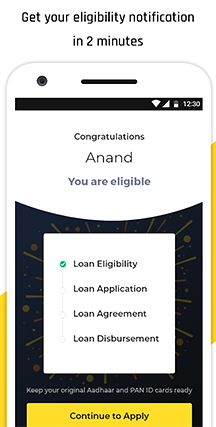

The entire process is online, starting from registration to disbursement and does not take more than 15 minutes. These Personal Loans can be availed online through KreditBee website and mobile app (that can be downloaded from Google Play Store on Android mobiles).

KreditBee acts as a technology intermediary to facilitate Personal Loans from regulated lenders to individuals with minimal documentation and instant disbursal of funds on approval.

KreditBee loan app currently offers Flexi Personal Loan, Personal Loan for Salaried, and Online Purchase Loan or E-voucher Loans.

Other instant loan apps| mpokket | cashe | Moneytap | Moneyinminutes | Paysense |

| Money View | Credy | Cashbean | Pochket | Nira |

KreditBee interest rate varies with the type of loan you wish to avail. The Loan interest rate ranging from 1.02% p.m. to 2.49% p.m. for Flexi Personal Loan, Personal Loan for Salaried, Personal Loan for self-employed and purchase on EMI.

Note: Check the lists of best personal Loan Apps available in India.

To apply for an HDFC Instant Personal Loan, you just need to complete a few steps:

Following are different types of KreditBee instant loans:

Additional Info: Check Best Loan Apps for Student in India.

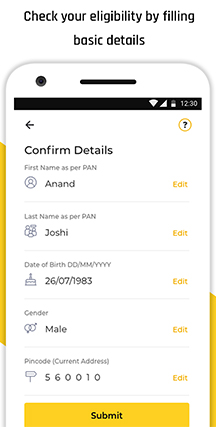

In order to be eligible for a personal loan KreditBee requires you to fulfill the following eligibility criteria:

Additional Info: Check Short Term Personal Loan Eligibility and Apply.

In order to apply for a KreditBee Personal Loan, just follow the below steps:

Alternatively, you can also apply through KreditBee's website by following a similar process.

You may get in touch with KreditBee Customer Care through the following options:

The Grievance Redressal Officer will try to resolve your grievance within 14 days from the date of receipt of a grievance.

Int Rates:1.33%-3%

Loan Amount:50000

Max Tenure:60

Int Rates:202.00

Int Rates:1.33%-2.41%

Loan Amount:1200

Max Tenure:48

Int Rates:235.00

Int Rates:10.5%-24%

Loan Amount:50000

Max Tenure:5

Int Rates:2149

Int Rates:12%-20%

Loan Amount:50000

Max Tenure:4

Int Rates:2633.00

Int Rates:15%-36%

Loan Amount:100000

Max Tenure:3

Int Rates:3467.00

Int Rates:10.50%-22%

Loan Amount:50000

Max Tenure:5

Int Rates:2149.00

Int Rates:2.25%-2.5%

Loan Amount:1000

Max Tenure:18

Int Rates:563

Int Rates:1.75%-24%

Loan Amount:100000

Max Tenure:7

Int Rates:1699

Int Rates:12.75%-44%

Loan Amount:5000

Max Tenure:42

Int Rates:1068.00

Now get IDFC First Bank personal loan of Rs. 50000 to Rs. 40 Lakhs ( Rs. 75 Lakhs as per eligibility norms) at lowest interest rate starting from just 10.50% per annum and the processing fee is 0.5% to 2.50% of the sanctioned limit + GST.

Find out exactly how much you need to pay for your next purchase

Whenever you take a loan, it is important to calculate EMI.

Any Indian individual who is aged above 21 years and salaried or has another monthly income source can apply for a Personal Loan via the KreditBee Platform.

Kreditbee Loan Interest rates vary between 1.02% p.m. to 2.49% p.m.

No. You can avail only one loan at a time through KreditBee app.

You can check your credit limit amount or maximum disbursement amount from the KreditBee app.

Yes. Depending on your past repayment behaviour and documents provided by you, you can avail a loan of more than Rs. 1 Lakh.

You can find your loan's repayment date by logging into the KreditBee app. The repayment tenure may vary between 3 to 24 months from the date of disbursal.

Processing fees for KreditBee instant loan may vary between Rs. 85 to Rs. 1,250 for Flexi Personal Loan, Rs. 500 to 6% of the loan amount for Personal Loan for Salaried, and 0% to 5% of the loan amount for E-voucher Loans.

Yes, you can make prepayments on your KreditBee Personal Loan without any added charges. All you have to do is send an email to help@KreditBee.in to get details of making prepayments or foreclosures on loan.

Customers will have to make all EMI payments towards the loan through the KreditBee application. This can be done using credit cards, debit cards, UPI, mobile wallets, net banking, and other online services. You can make KreditBee online payment by opting for an auto-debit option from your account for repayments on the dedicated due date.

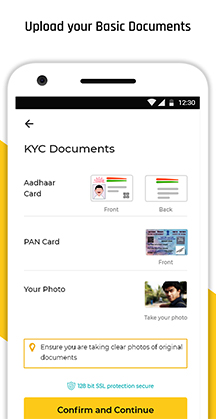

In order to avail your Personal Loan, you have to provide an E-signature. For this, an Aadhaar linked number is preferred. If you do not have an Aadhaar linked mobile, you can also register using an OTP sent to the registered number.

Yes. A joint account may be provided by the user. It is mandatory for the applicant to be one of the account holders.

Yes, you can get a loan even if your current profession is not mentioned in the application. Send an email about your employment details to help@KreditBee.in.